Are all Mutual Funds risky?

Every investment we make involves a risk, only its nature and degree varies. The same applies to Mutual Funds too.

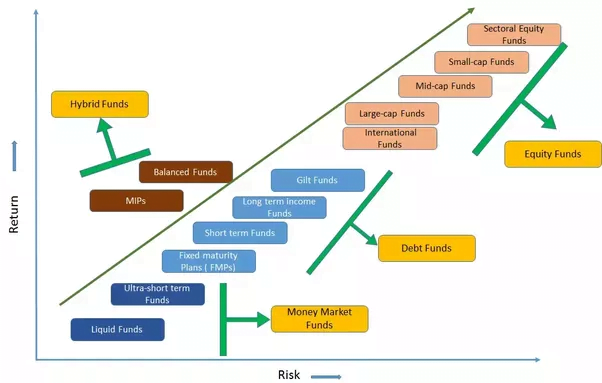

All Mutual Fund schemes do not carry the same risk when it comes to returns on investment.

Equity schemes have the potential to deliver superior returns over the long term that can create wealth. Remember, inflation is a risk, and equities are the best asset class to beat inflation. So, in a sense, there are some risks that are worth taking.

On the other hand, the risk associated with liquid funds is significantly low when compared to equity funds. A liquid fund focuses on the protection of capital by taking lower risks and generating returns in line with the risk taken.

It is also important to remember that the risk on returns is not the only risk you need to consider. There are other risks – liquidity risk for instance. Liquidity risk measures the ease of converting your investment into cash. This risk is lowest in Mutual Funds.

In the end, the nature and extent of risk are best understood through proper understanding and evaluation of the scheme and by taking the guidance of a Mutual Fund distributor or an investment advisor.

What are the various types of mutual funds?

Is Choosing a Mutual Fund too confusing?

Yes, there are several types of Mutual Fund schemes – Equity, Debt, Money Market, Hybrid, etc. And there are many Mutual Funds in India managing several hundreds of schemes amongst them. So it may appear that zeroing in on a scheme is actually a very complex and confusing affair.

Choosing the scheme to invest in should be the last thing on an investor’s mind. There are several more important steps before that, which will help remove much confusion later.

An investor should, first of all, have an investment objective, say retirement planning or renovating one’s house. The investor has to arrive at two figures – how much would this cost and how long it would take, while also knowing how much risk can be taken.

In other words, based on an investor’s goals and objectives and risk profile, a type of fund is recommended, say equity or hybrid, or debt, and only then specific schemes are selected, based on track record, portfolio fit, etc.

In essence, if there is clarity of investment purpose in the beginning, there would be a lot less confusion about the choice of the fund in the end.

Can Mutual Funds help create wealth?

Business and commerce allow us to create wealth by investing our money with those who are on the path to creating wealth. We can be investors in the businesses of entrepreneurs, by investing in stocks of various companies. As entrepreneurs and managers run their businesses efficiently and profitably, the shareholders get the benefits. In this regard, Mutual Funds are a great way to build wealth.

But how do we know which stocks to buy, and when?

That is where taking professional help counts. They also take advantage of a large corpus to explore more opportunities simultaneously. Like a balanced diet – we all need proteins, vitamins, carbohydrates, etc. Eating only one type results in some nutrient deficiency. Similarly, in a diversified equity fund you’re exposed to different segments of the economy, and also protected from the potential downside.

Invest in a professionally managed, diversified equity fund and stay invested for a long period to create wealth for yourself and your next generation.

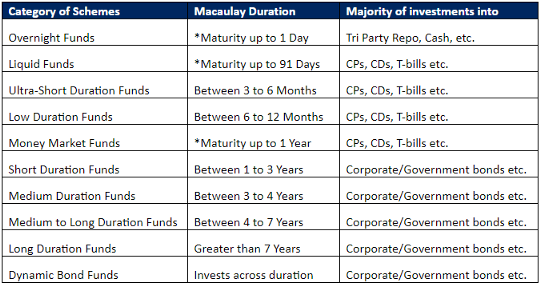

What are the various types of debt funds?

Debt funds are for investors who seek the safety of capital or regular income from investment and/or want to park money for short periods.

However, debt funds are of various types.

Like in banks, you can open a savings account, where you can put and remove money whenever you want. However, it doesn’t make sense to keep money idle, if you are not likely to use it for some time. You may, in such a case, open a fixed deposit – where the money is locked in a certain period allowing you to earn a higher rate of interest. You may also opt for a recurring deposit, wherein you keep investing a fixed amount every month for a pre-defined period of time. All these products help you with different requirements.

Similarly, among Mutual Funds too there are variants available in the debt fund category to fulfill various needs of investors, like – Liquid Funds, Income Funds, Government Securities, and Fixed Maturity Plans. An investor would be advised to select schemes based on one’s unique requirements.

Can one invest in multiple asset classes using one Mutual Fund scheme?

Mutual Fund schemes investing in a single asset category are like specialist bowlers or batsmen. Whereas certain other schemes, known as hybrid funds, invest in more than one asset category, e.g., some invest in equity and debt. Some may also invest in gold apart from equity and debt.

In cricket, we see batting all-rounders as well as bowling all-rounders depending on the skill, they are better at. Similarly, there are Mutual Fund schemes that invest heavily in one asset category as compared to another.

The oldest category, the balanced fund category, invests in equity and debt. The allocation to equity is normally higher (over 65%) and the rest is in debt.

The other popular category is known as MIP or the monthly income plan endeavours to provide monthly (or regular) income to investors. However, there is no guarantee of regular income. These schemes invest predominantly in debt securities so that regular income can be generated. A small portion is invested in equity to enhance returns over the years.

Another variation of the hybrid scheme invests in equity, debt, and gold, to take advantage of three different asset classes in one portfolio.

An investor has an option of buying different equity debt or gold fund schemes to create a hybrid portfolio or alternately buy a hybrid fund.

Are Mutual Funds ideal for short-term or long-term Investment?

“Mutual Funds could be a good saving tool for the short term.”

“You must be patient with your Mutual Fund investments. It takes time to deliver results.”

People regularly come across both the above statements, which are clearly contradictory.